#FREELANCE BOOKKEEPING FREE#

The bookkeepers in our network are happy to help you! Request up to three quotes free of charge and without obligation from different English-speaking bookkeepers in your area. Are you planning to start a business in the Netherlands? Then it would be smart to talk to an advisor and make a (financial) plan together. Need help managing your finances in the Netherlands? Good financial planning is crucial for every entrepreneur. English-speaking accountants and bookkeepers in the Netherlands.Starting a company in the Netherlands: tips and info.

#FREELANCE BOOKKEEPING HOW TO#

#FREELANCE BOOKKEEPING PROFESSIONAL#

Always consult the advice of a professional bookkeeper or accountant to check which rates and conditions apply to your situation.ģ.

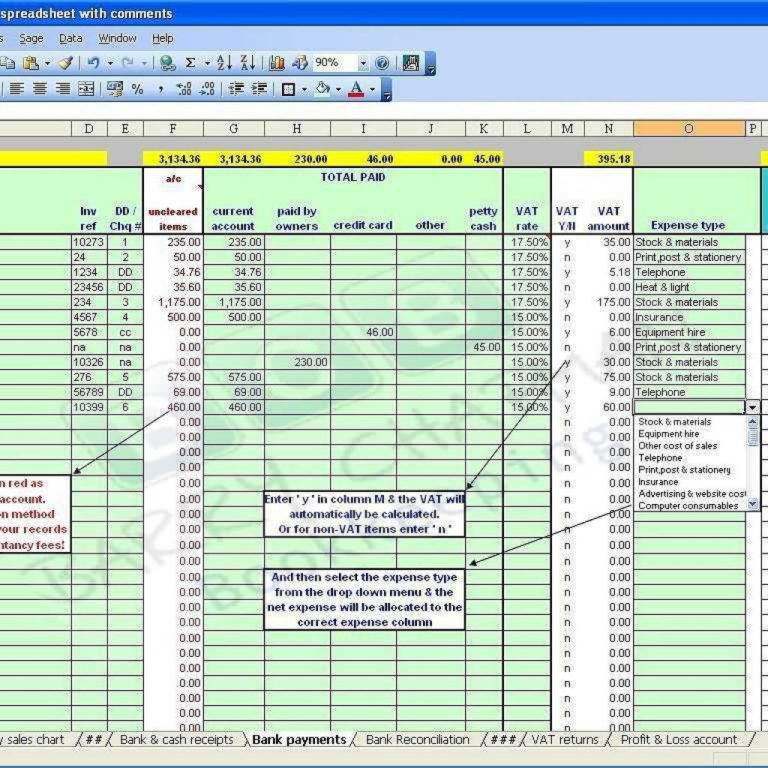

As a freelancer, you can make use of a number of additional VAT deductions, on top of the general VAT deductions. Not using VAT deductions Many freelancers lose a lot of money because they don't know which deductions they qualify for. We advise you to outsource your bookkeeping, so that you can be sure that the bookkeeping is done right and accurate.Ģ. In addition, you may have to deal with the reverse-charging VAT, especially when you do business abroad. Levying an incorrect VAT amount can be fined by the tax authorities, so be careful about this.

When creating an invoice for your clients, it is important that you enter the correct VAT rate for each specific type of item or service. Depending on your business, you might be dealing with different products or services that differ in VAT rates. For example, a low % rate is charged, while a higher rate should be stated on the invoice. You use the wrong VAT-rates A common accounting mistake is using the wrong VAT rates. 5: Starting your VAT return last minuteġ.By avoiding these mistakes you will save a lot of time, money and your business can grow even further. Below, we have listed the 5 most common mistakes that are made during bookkeeping in the Netherlands. Keeping track of finances as a freelancer in the Netherlands doesn't have to be difficult. Despite the growing popularity of self-employment, many find it difficult to deal with their finances. According to the Netherlands Chamber of Commerce (KvK), more than 1,1 million workers (about 17% of the population) are full-time self-employed in the Netherlands. The Netherlands has a high rate of freelancers and self-employed workers.

0 kommentar(er)

0 kommentar(er)